|

Submission by Guest Author

Financial literacy is vital to success in life and should be a part of any young person's education. By learning how finances work, young people will understand how, and why, to plan carefully as they make key financial decisions later in life. Why Financial Literacy Should Be Taught in Schools

Failure to acquire financial literacy can lead to catastrophic crises, such as bankruptcies, foreclosures, evictions, homelessness, inability to cover emergency expenses, inability to obtain desired medical or dental services, and other dire yet avoidable scenarios.

Conversely, acquiring skills in personal finance management can enable one to enjoy financial stability and earn exponentially more — through long-term investing — than one can from one’s salary. Financial literacy empowers an individual to live happily, healthily and securely throughout his or her life. Consider financial security impacts every facet of life including: ● Career choices ● Stress levels ● Home Buying and renting ● Marriage ● Raising children ● Dining, travel and entertainment ● Retirement ● Health care Understand How the World Works

Financial literacy also includes understanding how financial markets work. It will need to cover stocks, bonds, mutual funds, ETFs, and commodities, as well as the world’s great exchanges, like the London Metal Exchange, the Chicago Mercantile Exchange, and Intercontinental Exchange.

Such an education will also include the various instruments that can be used for investments, such as options, futures, and other securities. And it should include basic ways that students can analyze their investment choices such as comparing real estate investments to gold. Understanding these things will help students better grasp the meaning of national, regional, and world events. And it will provide the groundwork for a lifetime of delayed gratification — saving and investing. Stability of a Nation

Sounds finances also bolster the stability of a country. For example, research shows that the most stable societies are those where the majority of citizens diligently save and can therefore provide for themselves in emergencies and in retirement. The latter is particularly important, as with health care advances, people are living longer and need a larger “nest egg” than in decades past, in order to retire comfortably.

Savings rates vary between nations: China has one of the world’s highest rates, its citizens save an average of 25% of each paycheck. By contrast, Americans are an average of over $90,000 in debt. But during the uncertainty of the pandemic, the average savings rate of Americans reached over 32%. By contrast, their savings rate averaged between 6%-8% over the preceding decade. That said a nation’s debt also plays a factor in the stability of a nation, and helping students understand America’s debt can help them become informed voters. Understanding financial markets, including how commodities and stock exchanges work, as well as securities, is essential.

In a survey conducted by Credit Karma and Qualtrics, 63% of participants said they wanted financial literacy taught in schools.

Yet, while there's great consensus about the need for financial literacy in education, opinions on how, exactly to implement that objective vary. For instance, in that survey, roughly one-third each of respondents believed financial literacy education should begin in elementary, middle or high school, with small outliers, comprising about 5%, believing it should begin in college. Steps for Implementing Financial Literacy in Education

In 2007, the Consumer Financial Protection Bureau published, "A guide for advancing K-12 financial education" to help resolve some of these questions and to help educational institutions implement such programs. In this report, the authors parse the daunting project into a sequence of digestible actions:

AccessibilityImplementing financial literacy into the education systems of various school districts, each with its own unique set of challenges and resources, will require careful attention, and perhaps adaptation to concerns about equal accessibility to knowledge. Education Gaps

Financial literacy education must be implemented equally and uniformly across all districts and economic spectrums if it is to truly be effective in uplifting and securing the future of subsequent generations.

Next Gen Personal Finance published a report in 2018 called, "Who Has Access to Financial Education in America", which found that, in the poorest areas, the percentage of students required to complete a personal finance course in order to graduate high school was the smallest. For instance, access to technology plays a major role in how effective such a program can be in any given community. Many banks and brokerages now have mobile apps their customers can download onto their smartphones and mobile devices. In many cases, these apps include tutorials not only on utilizing the functions of the software but on better managing one's personal finance, from keeping a checkbook to creating a budget and saving and investing. Digital tools, like ClassCast Podcast create on-demand content giving students an even deeper dive into some of the more specific topics and challenges they may face in their financial education and lives. Using financial apps and digital tools, however, requires a means with which to use them. Despite the ubiquity of smartphones, some students still don't have them. Many don't have computers at home either, or ones they can access or that have access to the internet. All of these technological obstacles must be overcome in order for students to have equal access to learning financial literacy using these tools. Ways schools and districts can support greater access to the technology needed to run financial apps include:

The Role of Games

There are currently many games on the market, such as CashFlow, that provide a fun, engaging way to learn about financial management and to be rewarded for making the right choices.

Games provide an immersive, playful experience. Players get immediate feedback and learn through iterative actions and benevolent competition. Importantly, academic research shows that games are effective educational tools. Conveniently, there are financial games available for all age levels. Some games are designed to be played in the classroom. Some are downloadable apps. And others are designed to be played online in a browser. Here are some examples of popular games:

In Summary: A Team Effort

If basic financial skills aren't taught in schools, where else will students learn them? Unless parents take on teaching their kids financial literacy or individuals seek it out themselves later in life, schools are the only places where these vital skills may be instilled.

Incorporating programs teaching these skills into classrooms requires the focused and combined effort of teachers, administrators, students, parents and the community at large. As the Wisconsin Department of Public Instruction laid out, it requires a clear mission and vision and must be relevant, learner-centered yet community-focused and connected to the standards of the educational system. It must also be properly integrated with other curricular areas, supported with sufficient resources and continuously evaluated and adjusted for effectiveness. If done right, however, schools can help their graduates go on to lead happier, healthier and more secure and prosperous lives. Other Resources "Closing the Financial Literacy Gap"; Laura Zingg, Teach for America "Resources and Downloads for Financial Literacy"; Edutopia

0 Comments

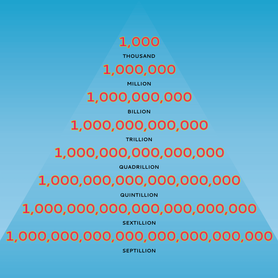

The Rubik's Cube, invented in 1974 by Hungarian sculptor and professor of architecture Ernő Rubik, is a puzzle with over 43 quintillion possible combinations. Yes, 43 quintillion! 43,000,000,000,000,000,000! For many, a puzzle with that many possibilities seems practically impossible to solve, but for decades, people have been improving the uses of the Rubik's Cube from just an experiment of the creator, to a logical puzzle game, to a sporting event that features incredible people known as “speed cubers.” Learning to solve the cube offers many benefits, including improved memory and problem-solving skills, the ability to map through the experience in learning algorithms, and improved reflexes from training to solve the cube at faster speeds. The cube also provides intangible benefits like discipline, perseverance, and self-confidence. And, of course, it makes for a hell of a conversation starter.

The benefits of learning the cube have been felt first hand by the team behind Cube Up Solution, a group of young, Black software developers and avid cubers who wanted to introduce more minority children to the wonder world of cubing. The team behind Cube Up Solutions believes that it is their duty to promote cubing in minority communities and help develop problem solving and technical skills of children, teenagers, and adults who may otherwise not appreciate the wonders of cubing.

The team behind Cube Up Solutions believe that the social and political landscape of the United States, especially for the Black community, is shifting and a change of focus and leadership is necessary. We believe leadership needs to shift focus from obtaining political power to acquiring more intellectual and economic power.

We hope to contribute to developing our future leaders of tomorrow by helping develop their problem solving and technical skills. We look at cubing, coding, robotics, genetics as fields that young children should be focusing on now so as they move into their future careers they have a foundation to help further the cause of creating equality of opportunity for all. We look at the Rubik’s cube as a perfect springboard to introduce kids to the skills they will need to survive and thrive in the world of tomorrow.

If you are interested in having your child learn the Rubik’s Cube, or if you want more information about Cube Up Solutions and what they can offer your community, please request more information via email at [email protected] or through Instagram under the handle @cubeupsolutions.

~~ Article and images provided by Cube Up! Solutions ~~

By Ryan Tibbens for educational purposes only

(Updated 4/28/2020 -- Scroll to the bottom of the article for some GREAT visual demonstrations from other sources.)

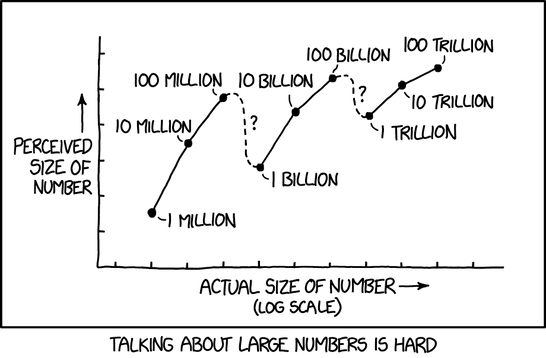

I just saw a time conversion that, when I think about it in dollar figures, is absolutely mind blowing. Here goes... - 1 million seconds equal 11 and 1/2 days. - 1 billion seconds equal 31 and 3/4 years. - 1 trillion seconds equal 31,710 years. That means if you have one billion dollars in the bank, you can spend a DOLLAR PER SECOND, every second, or $3,600 per hour, and not run out of money for nearly 32 years; and because of the interest you'll be accruing, it will actually be substantially longer than that. Now, let's think about wealthy people in the news. Robert Kraft, owner of the New England Patriots and patron of strip-mall whorehouses everywhere, is worth $6,600,000,000 (billion). If he converted all investments to cash, he could spend one dollar per second, every second for over 209 years, even without earning any capital gains. And, get this, he is only the 79th richest person in the United States. Jeff Bezos is the wealthiest person in the USA, with a net worth of over $160,000,000,000 (billion). That means he could spend a dollar per second, every second, or $3,600 per hour, for over 5,074 years. If we could travel through time (and given his wealth, he probably can), Jeff Bezos could start spending one dollar per second, every second at the beginning of the Bronze Age, and he'd just now be running out of money. The US national debt is currently about $21,974,000,000,000 (trillion), which means we would need to pay one dollar per second, every second, or $3,600 per hour, for 696,791 years to be debt free nationally. The average American household carries something like $140,000 of debt, which means that someone in that house would need to make and spend one dollar per second, every second for almost two days just to be even, just to be out of debt. Something is wrong. Data Visualization from outside sources

Since writing and posting this article a little over a year ago, I have encountered some great websites, videos, and posts that try to make the same point I did above -- big numbers are not at all what most people think they are. Before expressing opinions on issues that include big numbers -- government spending, economic inequality, personal finance, space travel, or anything else -- PLEASE review the sources below. WARNING: Link #2 might be the most startling and interesting, but because of this website's' formatting, it looks the least appealing. Definitely check out #2. Also remember that data changes all the time, so if you want to reference these sources, it is important to include production dates and context.

1) This 1-minute video uses grains of rice to compare hundreds of thousands to millions to billions.

2) This website offers a scrolling demonstration that includes commentary and explanations. Click the link, start scrolling right, read as you go, and keep scrolling right. Then scroll right some more. Seriously, this will blow your mind. https://mkorostoff.github.io/1-pixel-wealth/ 3) This is an oldie-but-goody. It is from late 2012, so the exact statistics are now inaccurate. Unfortunately, the numbers in 2020 are even more uneven and startling. For those who want to put wealth figures into more understandable terms like percentiles, this is a good visualization. (Just remember that the data is old.) 4) This demonstration compares the wealth of some of the leading Democratic candidates for president in 2019/2020. The candidates' names and politics are, for the purposes of the current discussion, less important than the visual comparison of wealth. CREDIT TO http://rossblocher.com/hosted/candidatewealth.html; check out his great work! Keep scrolling down! |

Read.Think.Write.Speak.Because no one else Archives

December 2021

Categories

All

|

RSS Feed

RSS Feed